Parte 1

- Una volta che hai messo un prezzo sui tuoi prodotti, puoi aggiungere le spese logistiche se necessario. Il tuo addebito logistico deve essere separato dal prezzo del prodotto, in modo che gli acquirenti possano facilmente vedere i due addebiti. Abbiamo i seguenti termini per la logistica;

Distribuzione in tutta l’isola

- Distribuzione del venditore

- Trasporto dell’acquirente

- Distribuzione di terze parti

- Distribuzione del venditore

La distribuzione di Gewattha.com ha utilizzato il termine “Spedizione” per la distribuzione e l’esportazione in tutta l’isola. Se gli acquirenti acquistano prodotti tramite gewattha.com, i venditori potrebbero essere in grado di consegnare i prodotti al luogo dell’acquirente con o senza addebito. Questo dipende dalla posizione di entrambe le parti. Entrambe le parti devono concordare quale sia il modo più conveniente per completare la distribuzione. Se il venditore non fornisce la distribuzione, un venditore deve menzionarlo nella descrizione del prodotto.

2. Trasporto dell’acquirente

Alcuni venditori non forniscono servizi logistici o possono ritardare la situazione, quindi se si desidera ottenere direttamente, gli acquirenti possono visitare il luogo del venditore, se possibile, con l’approvazione del venditore. Potrebbe essere necessario contattarci per tale richiesta.

3. Distribuzione di terze parti

Se l’acquirente o il venditore non è in grado di consegnare il prodotto, potrebbe essere possibile fornirlo a terzi. Una terza parte deve essere una persona fisica o giuridica registrata. Se terze parti non forniscono il servizio in modo appropriato, potrebbe sorgere un rischio e risultare in furto, danno o manomissione e non accetteremo alcuna responsabilità per tali incidenti.

Distribuzione internazionale

Potresti ricevere ordini esteri, quindi devi compilare il modulo di spedizione con il prezzo corretto sulla nostra piattaforma. Abbiamo una gamma di opzioni di tariffe di spedizione. Se non conosci il prezzo di spedizione, contatta il tuo spedizioniere o noi. Puoi distribuire tramite posta marittima o aerea. Verranno applicati costi separati e l’acquirente potrà vederli prima di pagare.

Conferma una spedizione

Al fine di fornire un servizio clienti efficiente e di alta qualità, abbiamo fornito ai venditori l’opportunità di esportazione diretta per confermare se il venditore desidera spedire: Il processo di spedizione come segue.

- I venditori possono scegliere la compagnia di spedizioni che utilizzano.

- I venditori possono utilizzare sacchetti di plastica, scatole, pellicola estensibile, confezioni di bolle, cartoni, pallet, ecc. per la spedizione.

- Per l’invio di prodotti, i venditori possono anche ottenere forniture gratuite da UPS, FedEx, DHL, USPS o corrieri locali.

- Il venditore deve inserire un URL di tracciamento della spedizione per il tracciamento della spedizione.

- Dopo aver completato la spedizione, possono contrassegnare un ordine come completato.

-

Il cliente può:

- Visualizza lo stato della spedizione di ogni articolo ordinato

- Avere l’URL di monitoraggio per controllare lo stato nei dettagli

- Alla ricezione di un articolo, possono anche “Segnare come ricevuto”

- Il venditore dovrebbe prestare attenzione al fatto che Gewttha.com ha il diritto di rifiutare, restituire o riconfezionare qualsiasi prodotto che non soddisfi i requisiti di imballaggio.

- Sarà fondamentale per i venditori aderire a seguire metodi di distribuzione pertinenti al fine di evitare di ricevere recensioni negative del venditore, resi, danneggiare il prodotto o sprecare materiali o denaro.

Gestione delle consegne

- Se vuoi gestire la tua Delivery puoi crearla tramite il nostro network. Si prega di seguire il metodo di seguito.

- Impostazioni dashboard → Persone di consegna → Tempi di consegna

- Venditori e clienti possono vedere attraverso il sistema la data esatta, l’ora, la persona di consegna, il prodotto consegnato, in procinto di consegnare, il prodotto in sospeso o la cancellazione.

- Queste impostazioni sono per individui ed entità che consegnano prodotti su base giornaliera.

Creazione di un sistema di distribuzione e spedizione

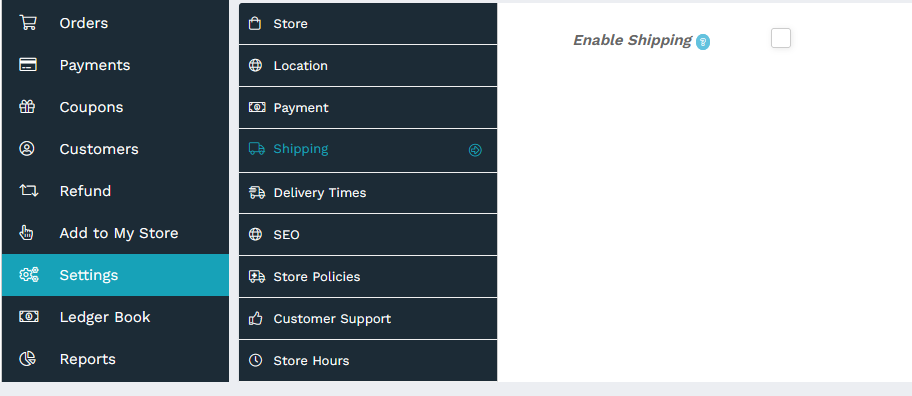

Nessuna impostazione di spedizione.

- Se non utilizzi l’impostazione di spedizione, disabiliti “Spedizione” nell’impostazione , come mostrato nell’immagine.

- Ciò significa che devi consegnare gratuitamente o che l’acquirente può visitare il tuo posto e portarlo via.

- Devi menzionare nella “Descrizione completa” del prodotto che non fornisci spedizione e distribuzione.

- Il cliente non ha bisogno di utilizzare Google Map se disattivi la spedizione.

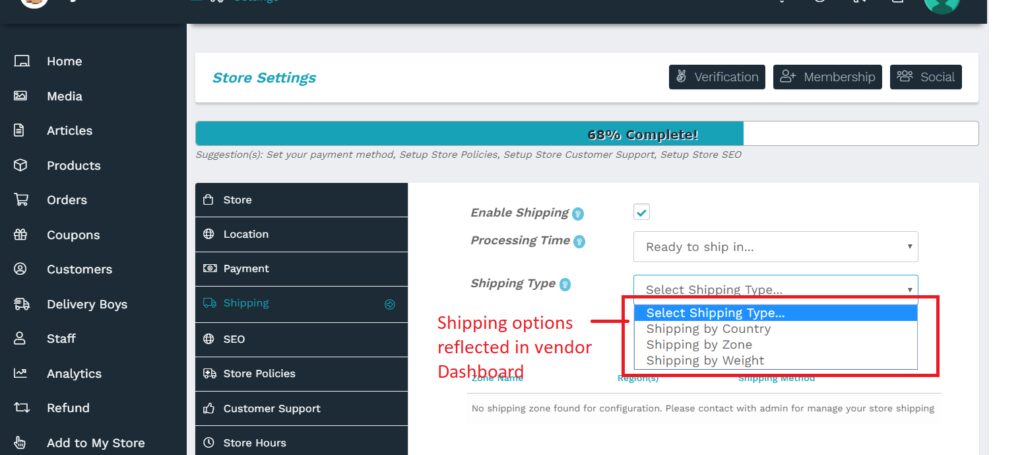

Spedizione e distribuzione

- Spedizione a distanza

- Spedizione in base al peso

- Spedizione per Paese

- Spedizione per zona

- È possibile impostare tutte le cifre per ciascun metodo in una volta , ma è necessario utilizzare un solo tipo di spedizione PREDEFINITA per il pagamento. Significa che se si salvano tutte le impostazioni e la distanza selezionata come metodo predefinito, non è possibile esportare con il metodo “Spedizione nazionale”. Per fare ciò, nelle impostazioni di spedizione, è necessario selezionare il metodo predefinito come “Spedizione per paese”.

- Non esiste un sistema di scambio automatico tra i 4 metodi di spedizione, quindi è necessario selezionare manualmente l’impostazione predefinita per un’altra opzione di spedizione.

Per esempio;

Memorizza Metodo predefinito – Distanza (Sri Lanka)

Cliente – da un altro paese (USA) → Quindi, è necessario selezionare il tipo di spedizione predefinito come “Spedizione per Paese”.

In caso di difficoltà nell’impostazione della spedizione, la configureremo gratuitamente per te, è necessario informarci di tutti i dettagli in qualsiasi formato scritto.

- Potrebbe essere necessario impostare i metodi di spedizione solo una volta , in seguito è possibile modificare le cifre in base alle necessità di distribuzione.

- Le impostazioni di distribuzione locale ed esportazione di spedizione effettuate in un unico sistema nella nostra piattaforma e puoi impostare i metodi di distribuzione più adatti.

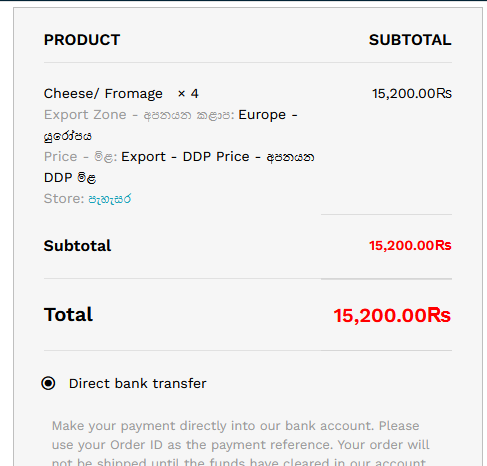

- Sia la distribuzione locale che l’esportazione vengono visualizzate sotto il nome di “Spedizione” nella nostra Dashboard e Pagamento alla cassa.

- Tutte le impostazioni possono essere regolate dalla dashboard del sistema e aggiunte automaticamente alla fattura finale separatamente nel pagamento alla cassa.

- Pannello di controllo del fornitore -> Impostazioni -> Spedizione -> Abilita spedizione -> Seleziona il tipo di spedizione.

- La spedizione può anche essere specificata nelle specifiche del prodotto (Specifica = Attributi).

- Tempo di elaborazione – Quanti giorni sono necessari per realizzare i prodotti.

- Classe di spedizione – Le classi di spedizione sono il gruppo di prodotti di tipo simile che possono essere spediti su tipi di prodotto come Classe 50, Classe 65, Classe 92.5, Classe 125, ecc.

- Utilizzare il pulsante “Salva” prima di passare ad altre impostazioni.

- Se non sei sicuro di abilitare le impostazioni di spedizione, invia un messaggio interno in formato scritto con i dettagli, lo risolveremo per te.

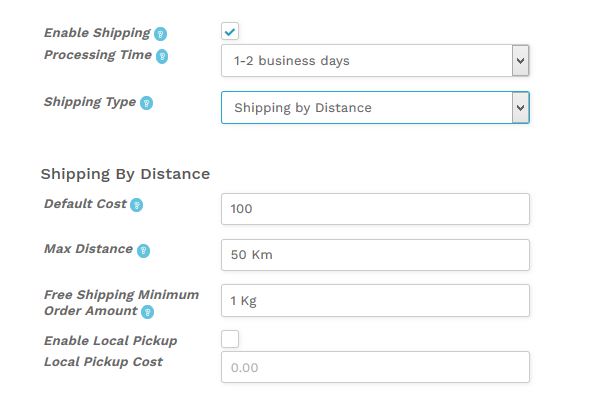

01). Spedizione a distanza

Ciò include il calcolo dei costi di consegna in base alla distanza del venditore. Il calcolo accurato della distanza passa attraverso ‘GPS – Google Map’ determina il prezzo per la posizione più vicina dell’acquirente.

Se non riesci a trovare la posizione tramite Google Maps in alcuni luoghi, ti indicherà la città o il villaggio più vicino. In tali casi sia l’acquirente che il venditore dovrebbero posizionare quello più vicino .

Per lavorare con la posizione del fornitore di spedizioni a distanza è essenziale. Quindi assicurati che i fornitori debbano inserire la loro posizione usando la mappa; collocamento -> Posizione.

- Attivazione del servizio – Abilita la spedizione

- Tempo di elaborazione del prodotto – Tempo necessario per elaborare il prodotto.

- Tipo di spedizione – Sorseggiando per distanza

I. Costo predefinito:

Il costo predefinito è la consegna iniziale o il costo di spedizione di tutti i prodotti nell’ambito della spedizione a distanza. Se non hai altri costi, questo è il costo base di consegna, se ci sono ulteriori costi, allora si riduce come segue;

II. Distanza massima

Se effettui la consegna, puoi impostare il prezzo per la distanza massima che consegni.

Nota: Se metti la distanza massima qui, gli acquirenti al di fuori di questo limite, non potranno acquistare, non consentirà il pagamento.

Se non hai la distanza massima puoi lasciare in bianco e quindi chiunque può acquistare prodotti da qualsiasi zona, o da qualsiasi paese.

Se consegni diversi chilometri in città, usa il metodo qui ‘Regola del costo della distanza’.

III. Spedizione gratuita Importo minimo dell’ordine:

Il numero minimo di unità richieste per la distribuzione gratuita.

IV. Abilita il costo del ritiro locale:

Costo per ottenere prodotti dal luogo del venditore.

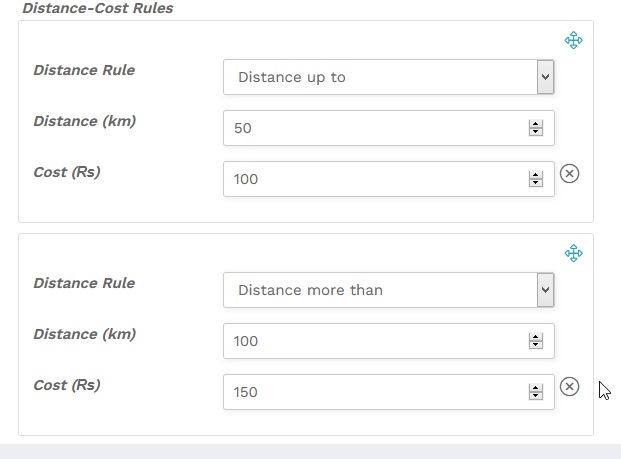

Regole sul costo della distanza:

Questo si aggiungerà al costo predefinito. Se non lo desideri, puoi lasciare queste opzioni vuote. Altrimenti, puoi lasciare vuoto il costo predefinito e regolare il costo della distanza utilizzando due opzioni.

- Distanza fino a

- Distanza più di

Usando questa tabella puoi mostrare il costo di consegna in base alle variazioni di distanza.

Ex:

Fino a 10 Km – 50 (Rupie)

Più di 100 Km – 200 (Rupie)

Più di 400 Km – 500 (Rupie)

Spedizione a distanza alla cassa #

- Per calcolare la spedizione in base alla distanza, gli utenti devono inserire la loro mappa utilizzando la posizione nella pagina di pagamento.

- Non appena gli utenti inseriranno la loro posizione verrà calcolato e mostrato il costo di spedizione.

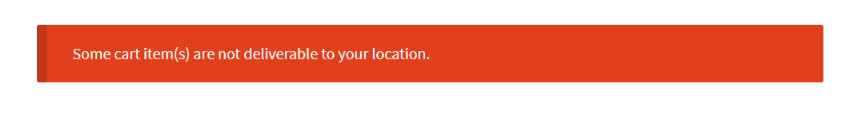

- Se la posizione dell’utente è superiore alla “Distanza massima” consegnabile del fornitore, verrà visualizzato un messaggio di errore e l’elaborazione dell’ordine verrà bloccata.

- Vedi l’immagine.

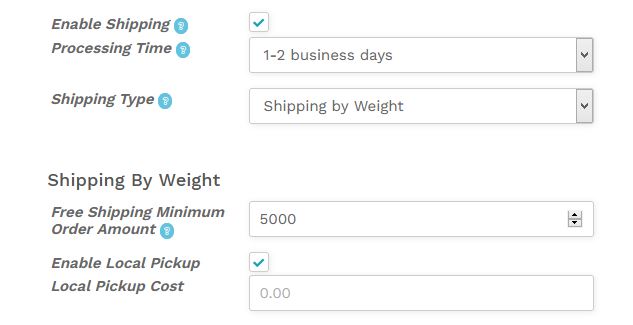

2). Spedizione in base al peso

- Abilita spedizione – Clicca qui per impostare e abilitare la spedizione.

- Tempo di elaborazione – Prenditi del tempo per la produzione prima della spedizione.

- Tipo di spedizione – Spedizione in base al peso

- Importo minimo dell’ordine di spedizione gratuita – Se il venditore offre la spedizione gratuita dopo un determinato numero di ordini.

- Abilita il ritiro in loco – Se il venditore consente all’acquirente di visitare il suo posto e portare via la merce.

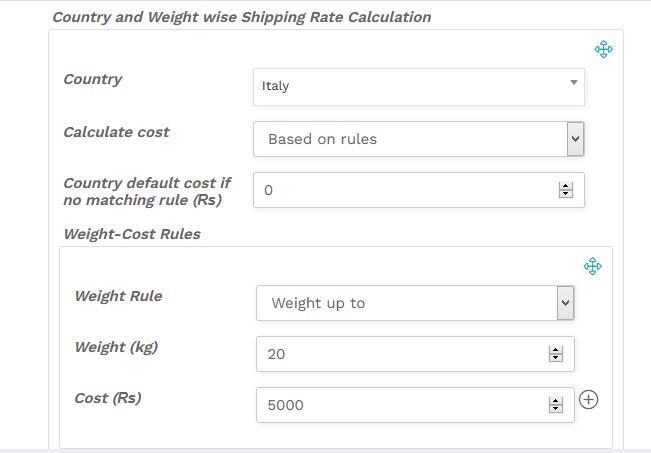

Calcolo della tariffa di spedizione in base al paese e al peso

- Paese: Paese dell’acquirente

- Calcola il costo: due modi

-

Calcola il costo in base alle regole:

Se l’utente sceglie di impostare regole per il calcolo, otterrà le seguenti opzioni come mostrato.

- Costo predefinito del paese se non esiste una regola di corrispondenza – In generale, se c’è un costo predefinito o un costo fisso per tutti i paesi, il venditore può inserirlo qui.

Regola del costo del peso;

Selezionare;

- Peso fino a

- Peso più di

Utilizzando questa tabella è possibile visualizzare il costo di spedizione in base alle variazioni di peso.

- Il peso:

La quantità di peso può essere inserita qui da Kg.

- Costo:

Qui il venditore può aggiungere il costo.

2. Calcolo basato su per unità:

Se l’utente sceglie di impostare le regole su base unitaria, otterrà le seguenti opzioni come mostrato: Una volta selezionato il costo unitario, all’utente verrà richiesto di inserire il costo che verrà aggiunto al Kg.

Tieni presente che l’utente può aggiungere più paesi e impostare regole facendo clic sulle icone (+).

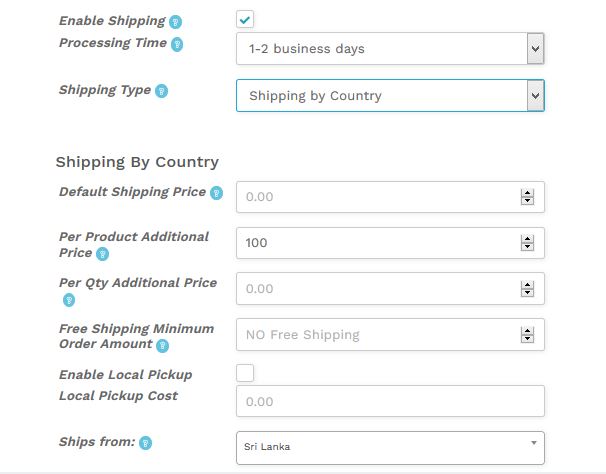

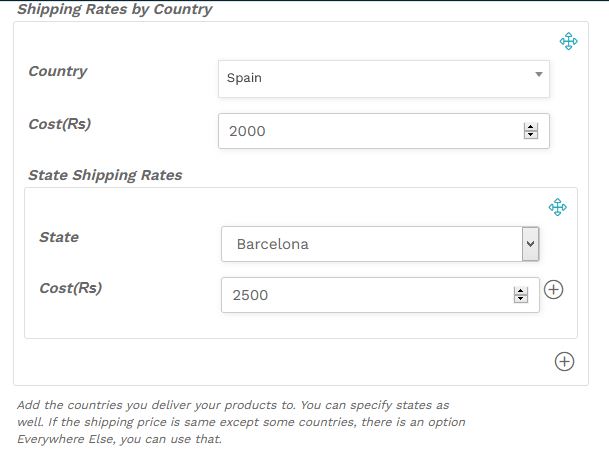

03). Spedizione per paese

Nelle impostazioni “Spedizione per paese”, i venditori possono impostare 4 diversi tipi di costi predefiniti.

- Prezzo di spedizione predefinito:

Questo sarà il prezzo di spedizione base di tutti i prodotti del venditore , indipendentemente dai paesi e dagli stati.

2. Prezzo aggiuntivo per prodotto:

Questo costo si applicherà a ogni secondo tipo di prodotto dello stesso venditore nel carrello.

3. Prezzo aggiuntivo per quantità:

Tale costo verrà applicato ad ogni seconda quantità dello stesso prodotto del venditore, presente nel carrello.

4. Spedizione gratuita Importo minimo dell’ordine:

L’importo qui inserito sarà il punto di riferimento al di sopra del quale la spedizione sarà gratuita.

Calcolo della spedizione:

- Spedizioni da: il paese da cui il venditore spedisce i prodotti.

- Tariffa di spedizione per paese; Paese dell’acquirente.

- Costo – Prezzo che appartiene a qualsiasi parte del paese dell’importatore

- Tariffa di spedizione per Stato; Costo totale fino alla zona di competenza. Questo non deve essere compilato a meno che il costo non vari a seconda delle regioni del paese.

- Le opzioni di cui sopra consentiranno ai fornitori di impostare le tariffe di spedizione per paesi specifici e i loro stati correlati.

I venditori possono impostare il prezzo di spedizione per ogni paese selezionando il nome del paese da ciascun menu a discesa. Il numero di caselle di selezione del paese può essere aumentato facendo clic sul segno più ‘+’ nella parte inferiore della casella di selezione del paese.

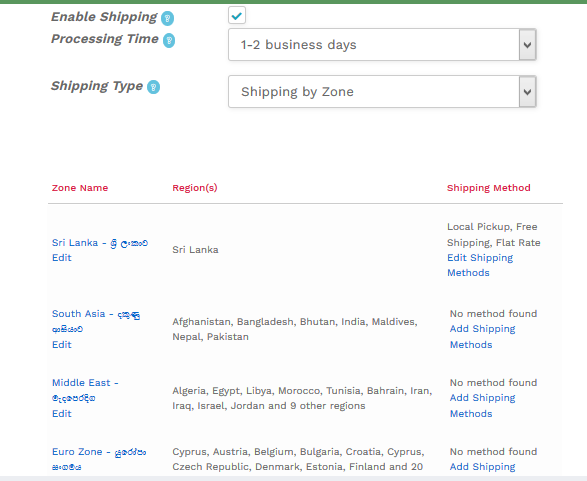

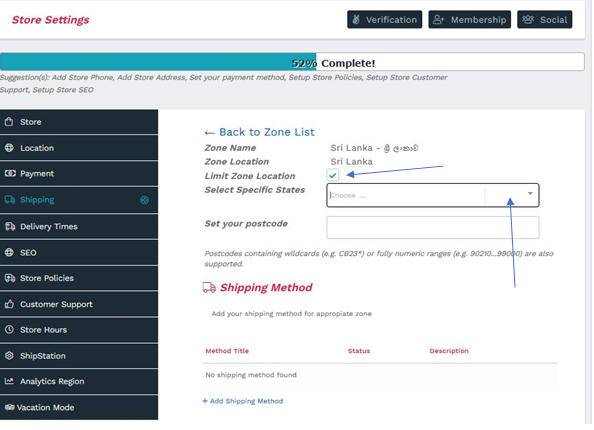

04). Spedizione per zona

-

È possibile impostare prezzi di distribuzione diversi per regioni diverse, per questo è necessario selezionare “Abilita spedizione”.

-

Le tariffe possono variare in base alla taglia, al numero di prodotti, alla taglia massima, ecc.

- Avrai 03 tipi di distribuzione con questo metodo.

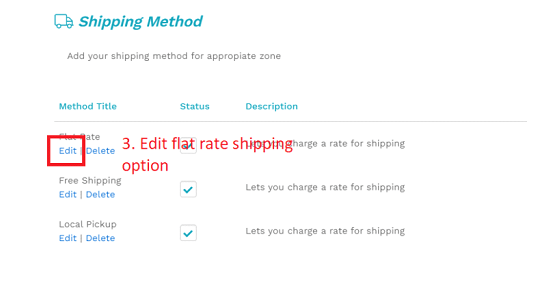

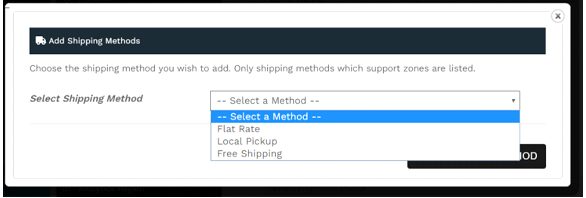

Aggiunta di metodi di spedizione

Per aggiungere metodi di spedizione, i venditori devono aggiungere “Metodo di spedizione” e quindi fare clic sull’opzione Modifica:

-

Metodo Titolo Stato Descrizione Ritiro in loco

Modifica | EliminaSolo i fine settimana consegnano Spedizione gratuita

Modifica | EliminaInformare in anticipo per ottenere la migliore spedizione gratuita Forfettario

Modifica | EliminaLa tariffa cambia in base a varie caratteristiche, come quantità, numero di prodotti, quantità minima, quantità massima, ecc.

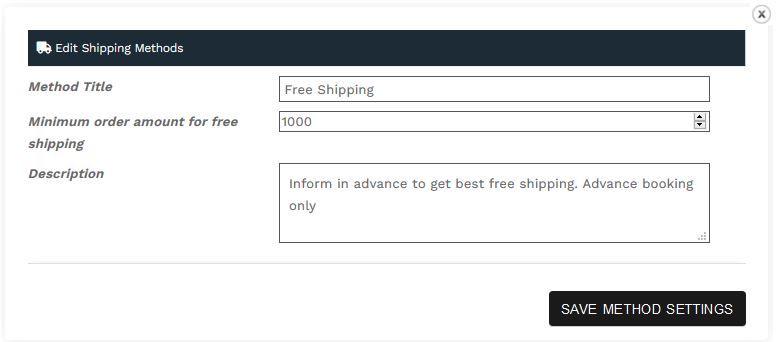

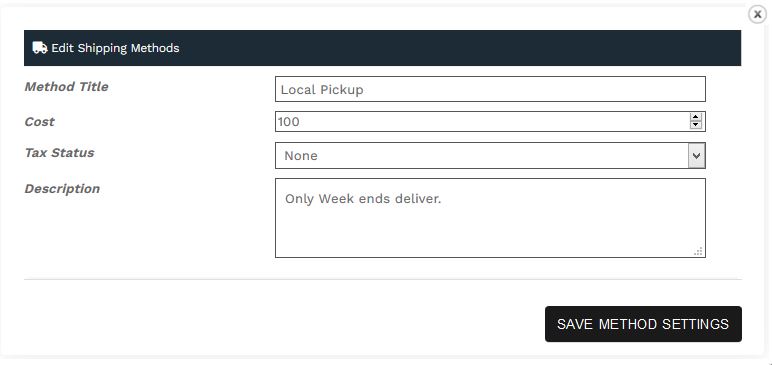

Dopo aver fatto clic su “Modifica” avrai un menu seguente.

un. Ritiro in loco

B. Spedizione gratuita

C. Forfettario

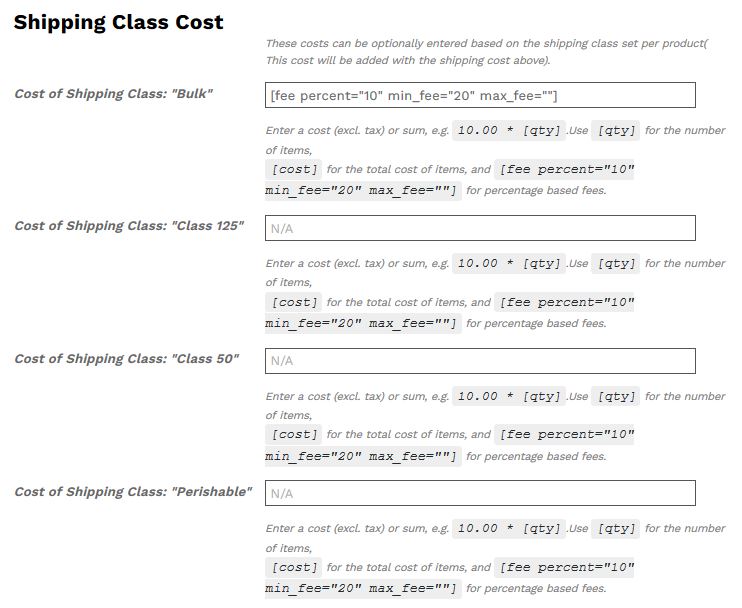

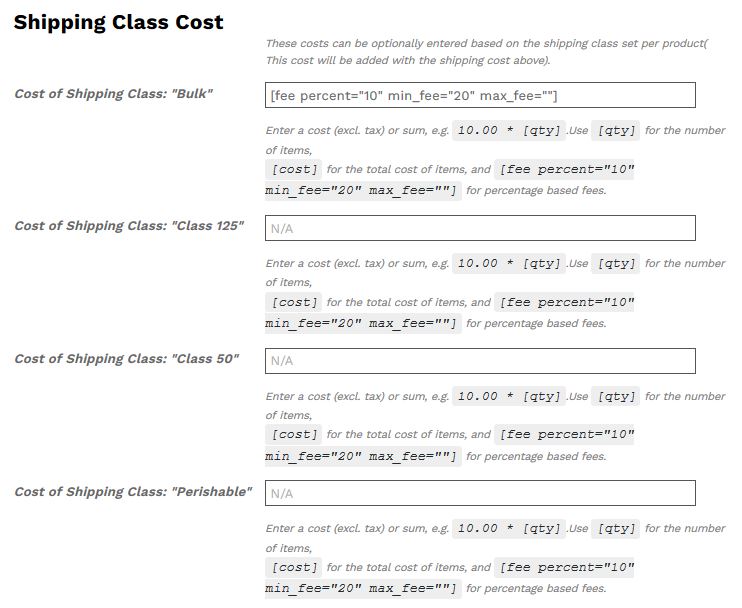

1. Spedizione forfettaria:

Qui ti consente di definire una tariffa standard per articolo, per classe di spedizione o per ordine. Semplicemente è un costo variabile sulla quantità.

Discutiamo brevemente i campi di cui sopra:

- Titolo del metodo: inserisci un titolo che venga visualizzato dai clienti al momento del pagamento.

Costo:

I venditori possono aggiungere costi aggiuntivi per articolo a questo campo. Questo può essere lasciato vuoto per disabilitare la Tariffa Forfettaria, tranne dove vengono aggiunti i costi per le Classi di Spedizione. Tieni presente che ciò che inserisci qui può influire sul costo complessivo nella sezione Classi di spedizione, a meno che non venga lasciato vuoto.

Di seguito sono riportati i segnaposto da tenere a mente durante l’inserimento del costo: È possibile seguire il passaggio per inserire il relativo costo di spedizione.

Stato fiscale: definire se l’imposta viene applicata o meno all’importo della spedizione.

Descrizione: è possibile inserire la descrizione della tariffa nella casella.

Di seguito i segnaposto da tenere a mente durante l’inserimento del costo:

[qty] – Numero di prodotti nel carrello

[fee] – Un costo aggiuntivo. Questa tassa ha due argomenti facoltativi.

percent – Una percentuale basata sul costo totale dell’ordine.

min_fee – Un importo minimo. Utile quando si usano le percentuali.

max_fee – Un importo massimo. Utile quando si usano le percentuali.

- Formato 1: 10.00 * [qty]

- Formato 2: [fee percent=”10″ min_fee=”20″ max_fee=””]

- Formato 3: 15 + [fee percent=””5″” min_fee=””2″”]

-

In base alla quantità

[qty] – Numero di prodotti nel carrello.

Formato 1: P* [qty]

- 20 + ( 3 *[qty] ) – Un costo di spedizione base di $ 20 più $ 3 per ogni articolo nel carrello.

2. Basato su una percentuale (%) – Una percentuale basata sul costo totale dell’ordine.

[fee] – Un costo aggiuntivo. Questa tassa ha due argomenti facoltativi.

- min_fee – Un importo minimo. Utile quando si usano le percentuali.

- max_fee – Un importo massimo. Utile quando si usano le percentuali.

Esempio:

- 15 +[fee percent=””5″” min_fee=””2″”] – Un costo di spedizione base di $ 15 più il 5% del totale dell’ordine, che è almeno $ 2. Significa che l’acquirente deve pagare sul carrello; Costo + Spedizione, $ 15 + $ 2 = $ 17

Costo della classe di spedizione:

Se hai classi di spedizione, l’interfaccia aggiunge alcuni altri campi come mostrato nella foto sopra. Questi costi possono essere facoltativamente inseriti in base alla classe di spedizione impostata per prodotto (questo costo verrà aggiunto al costo di spedizione sopra).

- Costo della spedizione classe “X”

Inserisci il costo per una particolare classe di spedizione.

- Nessun costo per la classe di spedizione

Utile se si utilizza l’opzione Per classe. Altrimenti, usa il campo Costo.

Tipo di calcolo

Questo ha due opzioni:

- Per ordine: seleziona l’opzione più costosa in base ai costi di spedizione nel carrello.

- Per classe – Spese di spedizione per ogni classe di spedizione.

Sempre ‘SALVA’ per attivare un Metodo per portare a controllare la nostra pagina.

2. Spedizione gratuita

Questo metodo di spedizione offre al venditore alcune unità specifiche minime per la spedizione. Se l’acquirente acquista una quantità minima, il venditore può effettuare la spedizione gratuita.

3. Ritiro locale

Il Ritiro Locale è un metodo che consente al cliente di ritirare l’ordine da solo presso la sede del venditore. Il venditore può configurare la relativa tassa e costo da qui. In questo modo il venditore può configurare le opzioni di ritiro locale per il proprio negozio. Se non ci sono costi, puoi mettere Zero.

Parte 2

Procedura di esportazione

Export Process steps

- 1. Obtaining License

- If there is an individual or an institution that wants to export goods directly from any country to another country, it is required to register with the relevant government agencies in that country.

- If you are not a direct exporter or company, you can deliver your goods to the relevant courier company or export company. They transport goods from your home or place of business to the importer's place.

- If you live in Sri Lanka, this link will help you register; https://www.srilankabusiness.com/pdf/export-procedure-21-10-2014.pdf

- 2. Goods Order/ Proforma Invoice

- The export process usually begins with the buyer's order request.

The buyer who wishes to buy the goods from the other country sends an inquiry relating to price, desired quality, terms, and conditions for the export of goods which is known as Trade inquiry/order. - The exporter sends a 'quote' in response. The form that contains information about its selling price, quantity, quality, distribution method, etc. is called 'Proforma Invoice'.

- A proforma invoice is an initial bill or estimate invoice that is the first bill issued by the exporter to request payment from the dedicated buyer for the goods or services before it is delivered. The price is not yet agreed so it is not a true invoice.

- Your buyer will need a proforma invoice to arrange the finances and open a letter of credit.

- The export process usually begins with the buyer's order request.

- 3. Methods of Payment /Letter of Credit (LC)

- After sending the proforma invoice, the exporter demands a Letter of Credit (L/C) from the importer.

- Then importer should request from his bank to issue a Letter of Credit in favor of the exporter’s bank.

- Through the (L/C), the buyer's bank gives assurance to the exporter of accepting the bill of exchange of a certain amount.

- If required, the exporter can ask for advance payment or full payment also from the importer under this.

Notification

- If you are paying through gewattha.com you can use PayPal instead of this L/C. The importer then pays to Gewattha.com and the exporter wants to export the relevant goods.

- The advantage here is that the transaction can be done quickly and easily at any time from anywhere and there are no bank fees.

- The importer's cash is retained in PayPal.com until the exporter delivers the goods to the importer.

- If the exporter fails to send the goods, the money will be refunded to the importer.

- 4. Find a Freight Forwarder or Courier Service

- If your goods are ready for delivery, then you need to find a Freight Forwarder or Courier company to export your goods. They may seem similar, but freight companies and couriers take very different approaches to how they move packages.

- Both freight forwarders and couriers can provide delivery solutions for your items but this is based on products, time, cost, distance, and quantity.

- 5. Export Documents

- Exporters should seriously consider having the right freight forwarder to handle the amount of documentation.

- The following documents are commonly used in exporting; which of them are actually used in each case depends on the requirements of both our government and the government of the importing country.

- You may not require all documents based on your products, your courier company will inform & handle many documents on behalf of you.

- Commercial invoice

- Dock receipt

- Bill of lading

- Certificate of origin

- Warehouse receipt

- Inspection certificate

- Export license

- Packing list

- Health certificate

- Insurance certificate

- 6. Shipment Advice to the Importer

- The exporter sends shipment advice to the importer of the goods so that the importer gets informed about the dispatch of the goods.

- The exporter sends a copy of the packing list, a non-negotiable copy of the Bill of Lading, and commercial invoice along with the advice note.

- 7. Exporter Presentation of Documents to the Bank

- The next step for the exporter is to submit the relevant documents to the bank. This process is initiated to receive the payment from the importer’s bank account.

- The documents required to be submitted to the bank for receiving the payment are often referred to as the ‘Negotiable Set of Documents’. The process initiated by the exporter’s bank with the importer’s bank after receiving the Negotiable Set of Documents is commonly called the ‘Negotiation of the Documents’.

It is obligatory for you that after shipping the goods, you must hand over the relative documents within 21 days of shipment to your bank for onward despatch to the overseas correspondent bank.

The legal requirement is that the payment against exports should be realized through an authorized dealer in foreign exchange (Bank) within six months of the date of shipment.

- The following documents may generally need to be submitted to the exporter’s bank for initiating the process of payment realization:

- Commercial Invoice

- Bill of Lading

- Certificate of Origin

- Dock Receipt

- Inspection Certificate

- Insurance Certificate

- Export Packing List

- 8. Bank To Bank Documents Forwarding

- The negotiating Bank will execute the shipping documents and forward them to the Banker of the importer, to enable him to clear the consignment.

This process will be conducted as per the terms and conditions of the LC of the importer.

The bank then issues a bank certificate and attested copy of the commercial invoice to the exporter.

- 9. Generation of Bill of Exchange

- A Bill of Exchange is generated after consideration of the documents mentioned above, and is commonly known as the ‘Documentary Bill of Exchange’. This Bill of Exchange can be of two types.

Sight draft:

If the funds are to be paid immediately or on-demand.

Usance draft:

A time draft gives the importer a short amount of time to pay the exporter for the goods after receiving them.

Realisation of payment

- After the importer’s bank receives the documentary Bill of Exchange, it releases the funds for payment. Payment is released in both cases of sight draft or usance draft.

- The exporter’s bank receives the payment from the importer’s bank, and the account of the exporter is credited.

- Authorized dealers will issue Bank Certificates to the exporter, once the payment is received, and only with the issuance of the Bank Certificate, the export transaction becomes complete.

- 10. Customs Goods Declaration

- Clearance of goods is a statement expressing the terms and conditions described by Customs. It shows the customs procedure to be applied by the persons concerned (importer/exporter or agent) on the goods.

- These documents have to be submitted together with the declaration to Customs, and are therefore referred to as supporting documents such as the commercial invoice (e.g. for the invoice amount, seller and buyer), the transport document (e.g. for the consignor, consignee, means and mode of transport) or the certificate of origin, or that have to be submitted as proof of specific import/export conditions being met (e.g. import/export permits, health certificates and certificates of conformity with technical standards).

Parte – 3

Utili documenti di esportazione e importazione

Following Export & Import Documents May Require.

- 1. Bill of Lading

- A bill of lading is a contract issued by a carrier (shipping company) or its agent to the owner of the goods, confirming that the goods have reached an acceptable condition and are ready to ship.

- The bill of lading acts as a title of ownership of goods throughout the process of shipping, transportation, and receiving, the bill of lading is the sole proof of transaction. This legal document protects the shipper, the carrier, and the customer all in one place.

- The exporter needs a copy of the bill of lading to hand over to the bank if payment is done in a letter of credit.

- A bill of lading is a standard-form document that is transferable by endorsement.

Importance of the Bill of Lading Form

1.Evident of Shipment or Carriage:

The contract of carriage entered into between the “Carrier” and the “Shipper or Freight Owner” in order to carry out the transportation of the freight as per the contract between the buyer and the seller.

2. Receipt of Goods:

A BOL is a document that verifies that goods have been received by an agent, carrier, (3PL Third-party logistics), or others from one party. When this occurs, in most cases, the organization that takes possession of the commodity is responsible for its condition. The BOL provides a paper trail of evidence to support freight damage claims.

3. Title Documentation:

This essentially means that whoever holds the bill of lading has the title for possession or ownership of the goods.

- The following is the information that must be included:

*Names and addresses:

The full names and addresses of both the shipper and receiver (consignee).

*Purchase orders

Any special order tracking numbers can include as a reference number.

*Special instructions:

Here is where you will note instructions for the carrier that are not extra service requests like liftgate or delivery notification.

* Date:

This is the pickup day, and it may be needed as a reference to track your freight or when you reconcile shipping invoices.

*Description of items:

The shipper will verify with the carrier the type of packaging (such as cartons, skids, pallets, drums, or containers), the quantity of packaging or shipment units, the amount of space it takes in the shipping container, or platform, and the dimensions.

*NMFC freight class:

Classes are an industry standard for the transportation of goods. They are based on NMFC tariffs and are a publication for motorists that includes rules, descriptions, and ratings of all products. It is divided into 18 classes of shipping.

*Department of Transportation hazardous material designation:

Hazardous shipments must be clearly cited and special rules and requirements apply when shipping.

*Declared Value:

The declared value for courier is equal to the cost of purchase of the item.

The declared value for customs i.e price at which the item is sold.

Customs use this value to clear your shipment and determine taxes and duties. Additionally, your commercial invoice should have the HS value and a detailed description of your shipment. If any of the information is inaccurate, your package will be held at the customs or courier services.The following acronyms can also include details around the bill of lading:

OBL: Ocean bill of lading.

AWB: Airway bill of Lading. - 2. Bank Draft

- Usually the seller’s bank will send the bank draft and related documents via the freight forwarder to the buyer’s bank.

- When the buyer authorizes payment for the goods, the bank releases the documents to the buyer and transfers the funds to the seller’s bank.

- There are two drafts; a sight draft requires an immediate payment while time drafts allow the importer to pay at a later date.

- 3. Certificate Of Origin

- It certifies that goods in a particular export shipment are totally obtained, produced, manufactured or processed in a particular country. They declare the ‘nationality’ of the product and also serve as a declaration by the exporter to satisfy customs or trade requirements.

- COs are requested by customs, banks, private stakeholders and importers for several purposes. Almost every country in the world requires CO for customs clearance procedures: when determining the duty that will be assessed on the goods or, in some cases, whether the goods may be legally imported at all.

The proof of review usually amounts to the chamber’s official embossing stamp and a signature of an authorized chamber representative. Some countries are accepting electronically issued certificates of origin that have been electronically signed by a chamber of commerce.

The product may be marked ' Made in Sri Lanka "Made in the USA" or "Made in China"

- Free Trade Agreements (FTA) with other countries don’t typically require a specific form to be used as proof of origin. Instead, they identify the information that must be included on a certificate of origin or some other document like the commercial invoice to prove that the goods qualify for preferential duty rates.

- 4. Commercial Invoice

- A commercial invoice is a contract and proof of sale issued by the seller to the buyer. This document describes the goods for sale and describes the price, value, and quantity of the goods. The commercial invoice is used by customs to calculate and assess customs duties and taxes payable on shipping.

- A commercial invoice is prepared to contain information about the buyer, the freight forwarder, the customs broker, the C&F agent, and the shipping to the bank. It is mandatory for all sea freight, air freight, and incoterms shipments. There is no specific format for creating an invoice. However, it should contain all the basic details of the transaction.

- A properly completed and correct commercial invoice for export helps customs authorities quickly decide which taxes and import duties apply to your package.

- A complete and accurate commercial invoice is indeed a legal requirement. Failure to do so may result in long customs delays and potential charges. Furthermore, providing incorrect information about a customs invoice can lead to lower payments on customs and taxes, which can have legal implications.

Commercial Invoice Checklist for Exports

Transaction Information

• Currency

• Instructions of payment

• Invoice data

• Invoice number

• Order number

• Sale totalExporter and Importer Information

• Exporter/Seller’s tax ID number (VAT, EORI)

• Exporter/Seller's name address, phone number

• Importer/Buyer’s name, address, phone number

• Importer/Buyer’s tax ID number (VAT, EORI)

• Notify party’s informationShipping Information

• Bill of Lading number

• Description of goods (number of packages, units, weight)

• Exportation date, mode of transport, and final destination

• Forwarding agent

• Harmonized System (HS) code

• Incoterms

• Insurance

• Origin of goods

• Shipper’s signature - 5. Dock Receipt

- A dock receipt is a receipt issued by a shipping company as proof of receiving the goods for shipment. A dock receipt ensures the carrier is accountable for the safe custody of the good until it is delivered to the destination. The bill of lading is prepared based on the dock receipt.

- The ocean carrier booking number in your dock receipt is the key number during all international cargo transportation. All the information related to your shipment connects to the booking number.

- If you utilize a third-party trucking company such as FedEx Ground, DHL Ground, etc., ensure that the carrier's booking number is the key number in your delivery order.

- This Suits for damages in the case of lost, missing, stolen, and damaged merchandise will require people to sift through the receipts, bills of lading, and other documentation to see when the problem developed and who was responsible for the shipment while the incident occurred.

- Standardized dock receipt forms are available from a number of companies involved in the shipping industry.

Warehouse Receipt

- After an individual or company drops of their goods at a warehouse or dock, they are given a receipt called warehouse receipt. A warehouse receipt is to ensures the quality and quantity of a particular commodity stored within an approved facility.

Warehouse receipts list the types, numbers, and other identifying characteristics of the stored goods. - The warehouse operator who has custody of the stocks guarantees delivery against the receipt and should be able to make good any value lost through theft, fire, or other issues.

- 7. Export Packing List

- A packing list is produced by the seller primarily for the use of the buyer, it contains information about the contents of the exported goods.

- The document will typically state a number of details relating to the shipment including how they have been physically packed, it is needed to generate the Bill of Lading. Simple mistakes of this document may result in unnecessary delays and their corresponding fees.

1 – Details of the exporter/consignor

- The full name, address, and contact details of the seller.

2 – Consignee & Buyer (if not Consignee)

- The full name, address, and contact details for the buyer

3 – Shipping Details

- Country of Final Destination.

- Country of Origin.

- Letter of Credit No (if goods are sold under a Letter of Credit).

- Marine Cover Policy No (if applicable).

- Method of Dispatch – Road, Rail, Air, or Sea Freight.

- Port of Discharge (POD).

- Port of Loading (POL).

- Type of shipment – FCL, LCL, Breakbulk, or other.

- Vessel / Aircraft Name.

- Voyage Number.

4 – Reference Numbers

- Invoice number

Sales order number. - Purchase order number.

- Any other reference number.

5 – Product Details

• Currency of transaction

• Description of goods

• HS Code

• Incoterm

• Price (per unit type)

• Product Code

• Unit Quantity

• Unit Type6. Marks and Numbers

- Identify any special marks, codes, numbers and so forth that may appear on your package. Number of Packages Enter the total number of packages, cartons, or containers for this shipment.

- All companies involved in the transport of your cargo (manufacturer, shipper, customs, carriers, warehouses, consignees, etc.) trust on the respective marks and numbers to distinguish it from all others

- This can and does often show as ‘Fully Addressed’ to represent.

7 . Type of packaging used.

- Wooden box, drums, corrugated carton boxes, pallets.

- The dimensions of each piece.

- The net weight and the gross weight for each piece.

8. Authorized Signatory

- Dated and stamped, affixes a stamp of authenticity to the packing list.

- 8. Health Certificate

- An Export Health Certificate (EHC) is a document used in export transactions, issued by the governmental organizations at the countries of origin, to certify that a food shipment is fit for human consumption, and meets safety standards or other required legislation for exporting.

- All food products which are subject to international trade, whether of animal or non-animal origin, must be fit for human consumption and comply with all relevant food standards such as hygiene, pesticides, genetic, labeling, contaminants, use of additives/preservatives, etc.

Following Products, you need an export health certificate (EHC) or other certificates to export or move:

- Processed food and drink

- Food or drink that contains products of animal origin (POAO)

- Vegetables, fruit, and other plants are used as food.

- Meat

- Dairy (milk, yogurt, cheese, butter & ice cream)

- Hides, skins, wool, feathers & lanolin

- Collagen, Gelatine, honey & animal casings

- Egg

- Fish and fishery products

- Pet food and animal feeds

- 6. Export License

- An export license is a document issued by government bodies allowing registered companies or individuals to legally ship goods that are otherwise restricted.

- The application process for an export license varies for each country. You can find out what you need to do on your country’s government website.

- Once you’ve received the export license, you need to include the export license number on the commercial invoice when shipping your goods.

- 9. Inspection Certificate

- Sometimes called a certificate of inspection or pre-shipment inspection certificate, an inspection certificate provides proof that what you are shipping is, in fact, what the customer ordered, and is also of good quality.

- The Certificate of Inspection is an inspection report or report of findings and is required by some importers or importing countries.

- The third-party inspection company issues inspection certificates after inspection and when the goods are shipped to the buyer's premises. There are well-known International Inspection Companies that carry out these activities.

- Generally, LC’s mandate the inspection certificate issued after the B/L (Bill of Lading).

- It is precipitated by the request for a Letter of Credit payment transaction that indicates an inspection certificate is required in order to fulfill payment obligations.

The following items are included in the content of the certificate of Inspection:

- Applicant :(The name of buyer company which has opened the LC).

- Consigned to the Order; The name of the LC opened bank or buyer bank’s.

- Beneficiary: (The name of the seller).

- LC No. and LC Date

- Custtom Tariff Code No.

- Proforma Invoice No. and Date

- Purchase Order No. and Date

- Insurance Policy No.

- Country of Origin

- Place of Inspection

- Date of Inspection

- Scope of Inspection

- Port of Discharge

- Type of Packing

- Number of Packages

- Description of Goods (with reference to the packing list number and Date)

- Bill of Lading No. and Date

- Gross weight

- Conclusion (as per LC, 46.A clause , if even there is syntax error in the LC should not be corrected)

- Name and Signature of Authorized Person

- Place and Date of Issue

- 10. Insurance Certificate

- Certificates of Insurance cover the importer/exporter for any possible damage to the goods while in transit. It contains details such as the insurance company, limits of coverage, policy number, consignee, and valid period for the policy.

- Your broker or freight forwarder can arrange insurance for your shipment.

Loss and Damage Claim

- Exporters use this form to claim insurance compensation for goods lost, damaged & delays during exportation. The claim must fully describe lost items and supporting documents, copies of documents necessary to support an insurance claim include the insurance policy or certificate, bill of lading, invoice, packing list, and a survey report (usually prepared by a claims agent).

- 11. Letter Of Credit (LC)

- A Letter of Credit (LC) is a document that guarantees the buyer’s payment to the sellers. It is issued by a bank and ensures timely and full payment to the seller.

- If the buyer is unable to make such a payment, the bank covers the full or the remaining amount on behalf of the buyer.

- The bank charges fees and commissions for playing the part of an intermediary.

- The fees required for LCs will depend on a variety of factors, including the risk associated with the contract, as well as the specific type of LC needed.

- An interest rate is usually established based on the amount involved and how long the buyer has to wait before receiving the goods.

- A percentage of the invoice value underwritten in charged, which is from 0.1% to 2.0% of the commercial invoice value per month.

- Who will pay the charges and will be mentioned in the charges clause of the LC. Mostly both parties agree that charges inside the countries of the applicant will be paid by the applicant and bank charges outside the applicant’s country will be paid by the beneficiary.

Buyer pays L/C Issuing commission, opening fee, advising fee and Transmission charges.

Seller pays L/C Advising Charge, amendment fees, discrepancy fees, etc.

Parties to a Letter of Credit

1. Applicant (importer) requests.

2. Issuing bank/Opening banker (importer’s bank).

3. Beneficiary (exporter).

Common types of letters of credit

- Revocable

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason.

2. Irrevocable

An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees. Irrevocable letters of credit provide more security than revocable ones.

3. Confirmed

A confirmed letter of credit is one to which a second bank, usually in the exporter’s country adds its own undertaking that payment will be made. This is used when the exporter does not find the security of an unconfirmed credit sufficient due to issuing bank risk or political and/or economic risk associated with the importer’s country. Only irrevocable LC can be confirmed, so a confirmed letter of credit provides more security than an unconfirmed one.

4. Unconfirmed

An unconfirmed letter of credit is one which has not been guaranteed or confirmed by any bank other than the bank that opened it. The advising bank forwards the letter of credit to the beneficiary without responsibility or undertaking on its part but confirming authenticity.

5. Back-to-back letter of credit

A broker or a financial institution can act as an intermediary between the buyer and seller. In such case, one letter of credit is issued to the intermediary. Two letters of credit (LCs) are involved in a back-to-back letter of credit transaction.The intermediary then secures a second letter of credit to complete the transaction. One is given to the intermediary and issued by the buyer’s bank while the other is issued by the intermediary’s bank to the seller where the seller is a beneficiary.

6. Transferable letter of credit

A transferable letter of credit permits an initial beneficiary to transfer some or all of the credit they are due to another party. The parties involved in a transferable letter of credit are the applicant (the buyer), the first beneficiary (the middleman), and the second beneficiary (the seller).

7. Standby

A standby letter of credit is an assurance from a bank that a buyer is able to pay a seller. The seller doesn’t expect to have to draw on the letter of credit to get paid.

8. Revolving

A single revolving letter of credit can cover several transactions between the same buyer and seller.

9. Sight LC

Sight LCs list precise conditions when the bank can release the payment to the service provider. These conditions may include certain documentation requirements along with an acceptable timeline for the delivery of goods. Proof of shipment is one of the required documents to release the payment. The payment requesting party must present this proof directly to the LC issuing bank. A sight LC causes payment to be made immediately to the beneficiary/seller/exporter upon presentation of the correct documents.

10. Time LC : term LC : Usance

Usance LC also known as Deferred Payment Letter of Credit or Time LC or Term LC is a letter of credit payable at a predetermined time / future date after the conforming documents are presented.

In the case of Usance LC, upon the receipt of documents by issuing bank if the documents are appropriate and comply with the terms of the LC, the issuing bank accepts the draft and pays on the maturity date as per the terms of the LC. This way the buyer receives the goods immediately but pays back the bank at a later date.

In other words, this letter of credit gives the buyer a grace period for payment. With the extra time, the buyer will receive the goods in his country and will be able to resell them or process&sell the goods. So with Usance LC, it is easier to cover the amount of letter of credit before the maturity date comes. Most of the time, Usance LC is preferred where a buyer and a seller have a close business relationship.

For instance, LC 30 days means LC is payable 30 days after Bill of Landing and if the BL date is 1 May, the payment due date will be 1 June.

- 12. Proforma Invoice

- No law prescribes the exact format of a pro forma Invoice, a pro forma invoice may look almost exactly the same as a commercial invoice. However, it should be clearly labeled “Pro forma”.

- A pro forma invoice is not an original/tax invoice. Therefore, it does not have any legal validity. Hence it does not legally bind either party in a supply transaction. It can be amended even after both parties sign it.

A pro forma invoice should include the following information:

** Unique invoice number.

** Date of preparation/issue.

** Address of the supplier.

** Address of the prospective buyer.

** Description of goods or services, including their unit costs and line-item totals

** Validity of the pro forma invoice

** Proposed terms of sale

** Terms of Payments (L/C, D/P, D/A, etc)

** Terms of Delivery (FOB, CFR, CIF, etc.)** Certifications required by “Customs Authorities” if any

Signature by an authorized person from supplier’s company.

Parte – 4

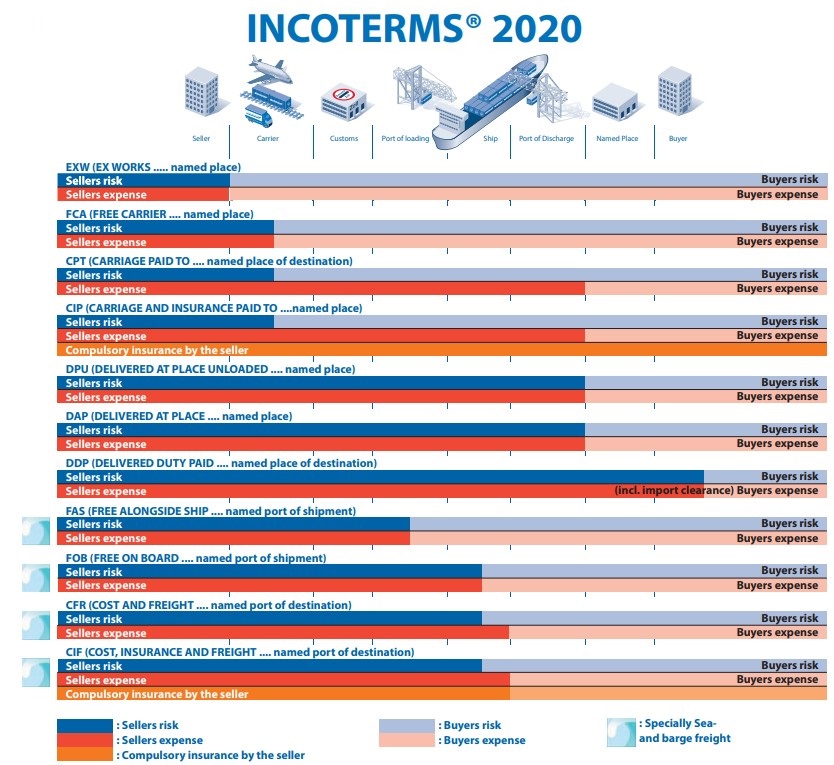

INCOTERMS - Le Condizioni Commerciali Internazionali

Incoterms 2020

- Definition

- The Incoterms or International Commercial Terms are a series of pre-defined commercial terms published by the International Chamber of Commerce (ICC) relating to international commercial law.

- ' The Incoterms® rules are the world’s essential terms of trade for the sale of goods. Whether you are filing a purchase order, packaging and labeling a shipment for freight transport, or preparing a certificate of origin at a port, the Incoterms® rules are there to guide you. The Incoterms® rules provide specific guidance to individuals participating in the import and export of global trade on a daily basis - Excerpt ICC'

- They are widely used in international commercial transactions or procurement processes and their use is encouraged by trade councils, courts and international lawyers.

- Incoterms 2020 is the ninth set of newest international contract terms published by the International Chamber of Commerce.

- Incoterms 2020 defines 11 rules

- Incoterms Types

The Incoterms are divided into four principal categories: E, F, C and D.

- Category E (Departure)

- Category F (Main Carriage Unpaid)

- Category C (Main Carriage Paid)

- Category D (Arrival)

1. EXW – Ex-Works or Ex-Warehouse

- EXW means that a buyer incurs all the risks of bringing the goods to their final destination.

- The seller meets its responsibilities by making the products available for pick-up by the customer at its location or another specified location (i.e. factory, warehouse, etc.)

- Either the seller does not load the goods on collecting vehicles and does not clear them for export, or if the seller does load the goods, they do so at the buyer's risk and cost.

- The buyer bears all of the costs and responsibilities from the moment the goods cross the warehouse prior to loading, Seller is only responsible for packing the goods.

- This Incoterm should not be used if the seller hands the goods over anywhere other than their own premises.

2. FCA – Free Carrier

- The seller delivers the goods, cleared for export, at a named place (possibly including the seller's own premises).

- The goods can be delivered to a carrier nominated by the buyer, or to another party nominated by the buyer.

- If delivery occurs at the seller's premises, or at any other location that is under the seller's control, the seller is responsible for loading the goods on to the buyer's carrier.

The buyer bears the costs from loading onboard to unloading, including insurance.

3. FAS – Free Alongside Ship

The seller is responsible for loading the goods on the buyer's transport/the ship/vessel nominated by the buyer at the named port of shipment and is responsible for delivery to the port and export clearance including security requirements.

The risk/damage to the goods is transferred from the seller to the buyer when the goods are alongside the ship. The buyer bears all costs from that moment onwards.

The buyer is responsible for loading onboard, storage, freight, and other costs up to delivery at the destination, including import clearance and insurance.

This Incoterm is only valid for shipping and is generally used for special goods that have particular loading requirements, not usually for palletised cargo or containers.

4. FOB – Free On Board

- Seller clears the goods for export and delivers them when they are onboard the vessel at the named port of shipment. The seller also arranges the transport although the buyer bears the cost.

- The seller bears the costs until the goods are loaded onto the ship.

- The risk of loss of or damage to the goods passes when the products are on board the vessel, the buyer bears all costs from that moment onwards.

- The buyer is responsible for the cost of freight, unloading, import clearance, and delivery at the destination as well as insurance.

5. CFR – Cost and Freight

- The seller pays for the carriage of the goods up to the named port of destination.

- The seller is responsible for origin costs including export clearance and freight costs for carriage to the named port.

- Risk transfers to buyer when the goods have been loaded onboard the ship in the country of Export.

- The buyer is responsible for import procedures, insurance, and transport to the destination.

6. CIF – Cost, Insurance and Freight

The seller bears all the costs up to arrival at the destination port, including export clearance, costs at origin, freight, and usually unloading.

- CIF requires the seller to insure the goods for 110% of the contract value/ minimum level of insurance under Institute Cargo Clauses (A) of the Institute of London Underwriters (which is a change from Incoterms 2010 where the minimum was Institute Cargo Clauses (C)), or any similar set of clauses, unless specifically agreed by both parties.

The seller must also arrange insurance even though the risks transfer to the buyer once the goods are loaded on board.

- This is widely used as it determines the customs value.

- This Incoterm is only used in shipping.

The buyer bears the import and transport to destination costs.

7. CPT – Carriage Paid To

- The seller pays for the carriage of the goods up to the named place of destination.

- The seller is responsible for origin costs including export clearance and freight costs for carriage to the named place of destination.

8. CIP – Carriage And Insurance Paid To

- The seller has the same responsibilities as CPT, but the seller is required to obtain insurance for the goods while in transit.

- Seller is responsible for the transportation costs associated with delivering goods and they also contract for minimum insurance cover against the buyer’s risk of loss of or damage to the goods during the carriage for the named place.

9. DAP – Delivered At Place

- Delivered-at-place simply means that the seller takes on all the risks and costs of delivering goods to an agreed-upon location. This means the seller is responsible for everything, including packaging, documentation, export approval, loading charges, and ultimate delivery.

- The buyer, in turn, takes over risk and responsibility as of the unloading of the goods and clearing them for import.

10. DPU (Delivered at Place Unloaded) (replaces Incoterm® 2010 DAT)

- Like DAP, the seller clears the goods for export and bears all risks and costs associated with delivering the goods to the named place, which can be a port or other named location in the import destination.

- The seller covers all the costs of transport (export fees, carriage, unloading from the main carrier at the destination port, and destination port charges.

- The buyer is responsible for all charges incurred after unloading (import duty, taxes, customs, and on-carriage).

- It is important to note that any delay or demurrage charges at the terminal will generally be for the seller's account.

- Insurance is not mandatory but if taken out the seller bears the cost.

11. DDP – Delivered Duty Paid

- The seller bears all responsibilities, risks and expenses related to the transportation of the goods until the buyer receives or transfers the goods at the port of destination. The agreement includes payment of transportation costs, import and export duties, insurance, and any other expenses incurred during transportation to the agreed location in the buyer's country/region.

- Unless the rules and regulations in the buyer's country are very well understood, DDP terms can be a very big risk both in terms of delays and in unforeseen extra costs, and should be used with caution.

- This Incoterm is the exact opposite of EXW, the seller bears all the costs and risks.

→ The policy should be in the same currency as the contract and should allow the buyer, the seller, and anyone else with an insurable interest in the goods to be able to make a claim.

→ Incoterms for any mode of transport: EXW, FCA, CPT, CIP, DPU, DAP, and DDP;

→ Incoterms only for sea and inland waterway transport: FAS, FOB, CFR, and CIF.

Parte – 5

Processo di importazione

Steps

- 1). Making an order or quote request

Importer shall make a quote from suppliers for the goods they want to buy.

- 2). Issuing a Proforma Invoice

Upon receipt of the order, the exporter will issue an estimate proforma invoice stating that it may be subject to change later if required.

- 3). Agree to Incoterm

Both the importer and the exporter must agree to a specific Incoterm method for shipping.

- 4). Making a letter of Credit

The importer should apply for a letter of credit through his bank following the proforma invoice. His bank then issues a letter of credit to the exporter's bank promising to pay for the products.At our site, in most cases, you can use online payment such as Paypal instead of a letter of credit. It will keep your money safe until the goods arrive at your door or place. The advantage here is that you can reduce bank fees and delays and make the payment process faster and make it from home.

- 5). Issuance of Commercial Invoice

Following the letter of credit, the supplier will issue a commercial invoice to the importer confirming the order. This invoice is the main document required for clearance of goods, describing the price and quantity of the goods sold and the incoterm.

- 6). Contacting freight forwarders

The seller or importer will set this up on their incoterm. The freight forwarder contacts the relevant supplier and exports the buyer's goods. Freight forwarders provide International freight forwarding and preparation of key documents used in the process.

- 7). Customs clearance

The goods are subject to import clearance upon arrival at the buyer's destination. Imported goods may be subject to certain taxes, duties, and/or fees in each country.

Import Permission / Permission:Importers may need to obtain an import license depending on the type of goods they are importing into a country. This is not mandatory for all goods, but if a supplier or buyer imports or exports prohibited goods, they may need a special license depending on which goods they decide to import or export. On the other hand, if you have an import license, you can get customs or tax benefits.

- 8). Delivery of goods to the buyer

Goods will be delivered to the importer or delivered to the relevant point of delivery if clearance is done properly through customs, According to the incoterm that takes place during shipping will determine who sets this up.

If the goods are damaged, the importer must notify to supplier or shipper within 03 days. If you have obtained cargo insurance, this will be done according to your goods insurance policy, otherwise, you will have to bear the cost of damages.

All of the above steps can be handled by an importer or exporter's licensed customs broker and freight forwarder. They will bring the goods to your doorstep or place for you named. All you need is to find the right product from the right exporter.

Parte – 6

Miscellanea

Import & Export

- Export Guidelines

- Individual countries will have specific requirements in terms of the types of documentation needed for products being imported. The requirements will differ depending on the country and the specific type of product.

- Within the European Union (EU) there is free movement of goods. Free movement is where goods, including food products, can freely move within the EU without customs checks, although there may be national controls where there are risks to public health.

- Local Authorities have the authority to sign export certificates to companies who wish to export certain food products to other countries. So please get those certificates before you export and send us copies to register you as a food exporter.

- Useful Websites

- Sri Lanka

- European Union

https://ec.europa.eu/food/horizontal-topics/international-affairs/import-conditions_en

- Gulf Foods Export & Import

- Import foods to Australia & New Zealand

https://www.agriculture.gov.au/import/goods/food

- United Kingdom

- USA

https://www.fda.gov/food/guidance-regulation-food-and-dietary-supplements/food-imports-exports

- China

- CE Mark

Manufacturers play a crucial role in ensuring that products placed on the extended single market of the European Economic Area (EEA) are safe. They are responsible for checking that their products meet EU safety, health, and environmental protection requirements. It is the manufacturer’s responsibility to carry out the conformity assessment, set up the technical file, issue the EU declaration of conformity, and affix the CE marking to a product. Only then can this product be traded on the EEA market.

If you are a manufacturer, you have to follow these 6 steps to affix a CE marking to your product:

- Identify the applicable directive(s) and harmonised standardsSearch for available translations of the preceding linkEN•••

- Verify product specific requirements

- Identify whether an independent conformity assessmentSearch for available translations of the preceding linkEN••• (by a notified body) is necessary

- Test the product and check its conformity

- Draw up and keep available the required technical documentation

- Affix the CE markingSearch for available translations of the preceding linkEN••• and draw up the EU Declaration of Conformity (27 KB).

These 6 steps may differ by product as the conformity assessment procedure varies. Manufacturers must not affix CE marking to products that don’t fall under the scope of one of the directives providing for its affixing.

For products that present higher safety risks, safety cannot be checked by the manufacturer alone. In these cases, an independent organisation, specifically a notified body appointed by national authorities, has to perform the safety check.

The manufacturer may affix the CE marking to the product only once this has been done.